Excerpt from the LDS 1940 General Handbook of Instruction: 1

Who Should Pay Tithing

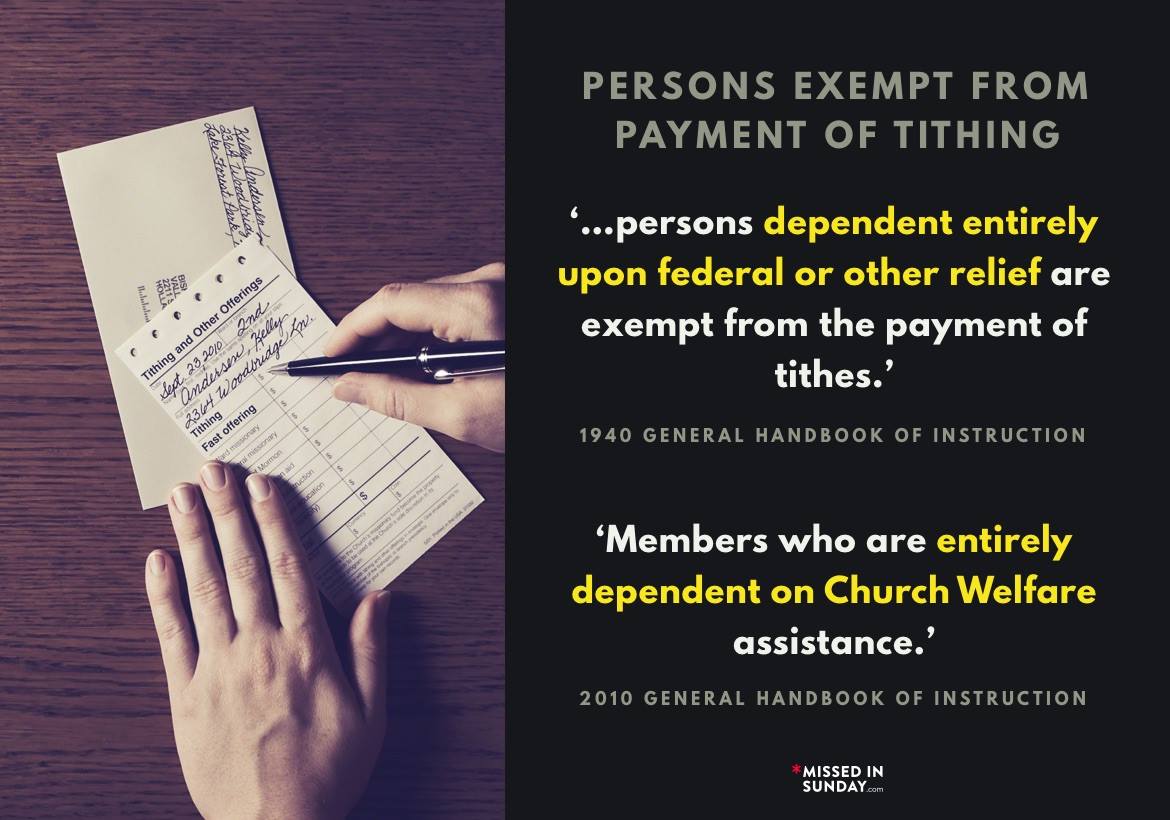

All members of the Church who have any income or increase from property, or who receive wages, salaries or gifts, should pay one-tenth of their “increase” annually. (See Doc. and Cov. 119:4.) Children eight years of age or over who have been baptized are amenable to the law of tithing and should be encouraged to tithe their earnings. They should be given an opportunity to pay some tithing each year. no matter how small the amount.Persons Exempt From Payment of Tithing

Aged persons without incomes; women who have no income separate from that of their husbands; children who have no individual source of revenue; and persons dependent entirely upon federal or other relief are exempt from the payment of tithes. Those receiving federal or other relief may be considered exempt because the relief rendered is supposedly only sufficient to sup-ply their absolute needs. All Latter-day Saints should be encouraged to cultivate the spirit and practice of tithe paying when conditions are such that they are able to earn.

Excerpt from the LDS 1968 General Handbook of Instruction: 2

Who Should Pay Tithing

Church members should pay one-tenth of their interest (income) annually into the tithing funds of the Church.Those without income (including wives who have no separate income from their husbands) , and those entirely dependent on relief, are exempt from the payment of tithing.

Missionaries on full-time missions are not required to pay tithing on money received from their families or others for their support. Additional personal income should be tithed.

Excerpt from the LDS 2010 General Handbook of Instruction: 3

Who Should Pay Tithing

All members who have income should pay tithing, with the following exceptions:1. Members who are entirely dependent on Church Welfare assistance.

2. Full-time missionaries. (However, missionaries should pay tithing on personal income beyond the amount they receive for their support.)

References

| 1 | General Handbook of Instruction (1940) – https://drive.google.com/file/d/0B9Vs4YXzKZEpcGNXcnh5NUFobk0/view?usp=sharing |

|---|---|

| 2 | General Handbook of Instruction (1968) – https://wlstorage.net/file/mormon-general-handbook-of-instructions-1968.pdf |

| 3 | General Handbook of Instruction (2010) – https://onedrive.live.com/redir?resid=42CC14E97C160EBE%2112478&authkey=%21AJVCwROgxQq8OtU&ithint=file%2Cpdf |